Later the Malaysian government issued the Malaysia Global Sukuk a landmark Sukuk Ijarah worth US600 million and became the first country in the world to issue a global. Sukuk has various types of contracts that vary from one transaction to another Read different types of Sukuk contracts in Malaysia here.

Malaysia Sukuk Market In A Glance Bix

Discuss the legal and Shariah.

. TYPES OF SUKUK By. The list should include at least. By the end of this programme participants will be able to.

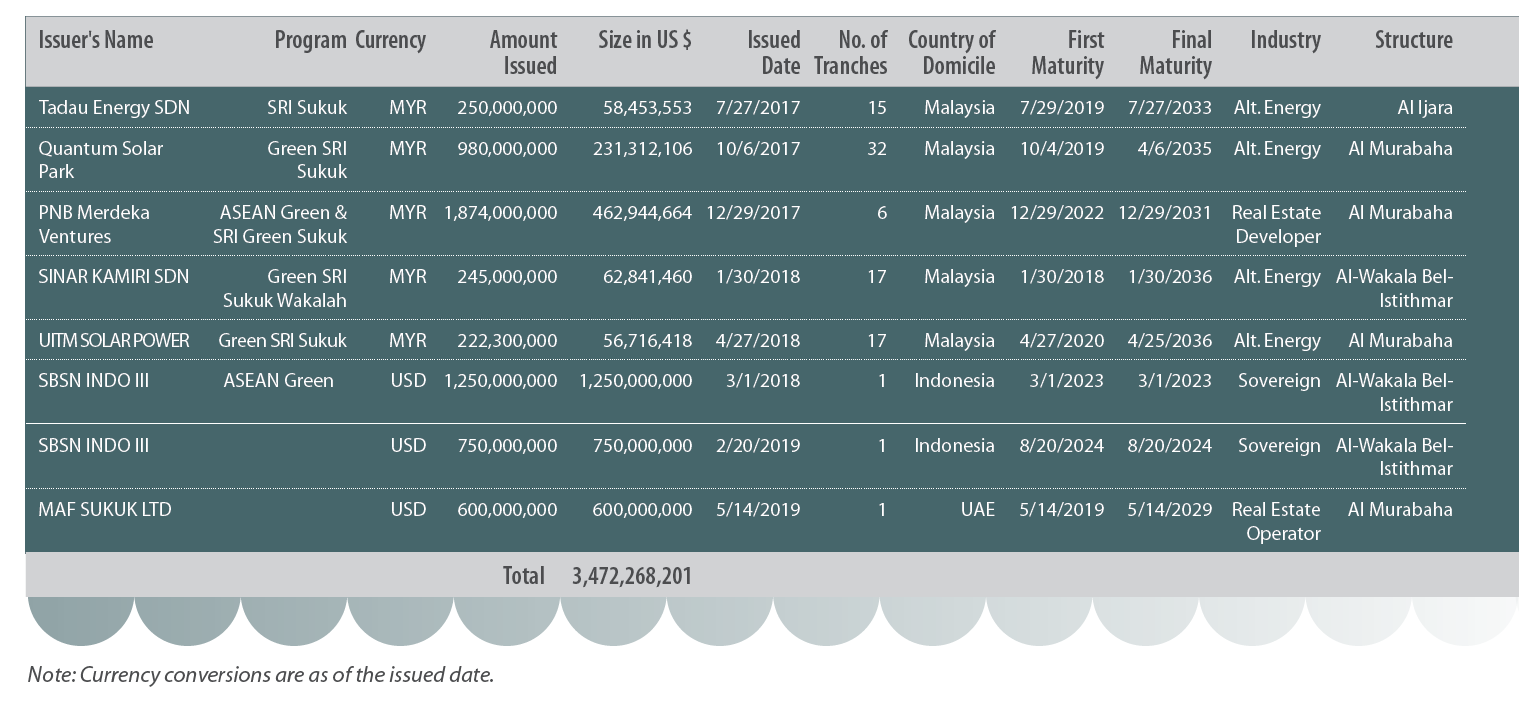

The Accounting and Auditing Organisation for Islamic Financial Institutions AAOIFI which issues standards on accounting auditing governance ethical and Sharia. Abstract and Figures. In 2017 Malaysia issued the worlds first green SRI sukuk to.

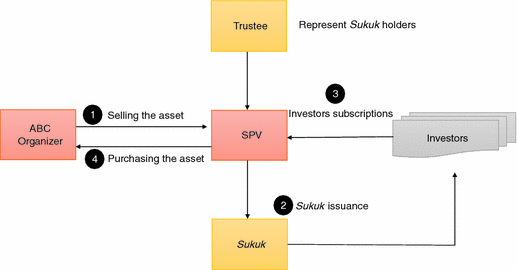

Sukuk and bonds are two kinds of financial instruments that share the Malaysian capital market. Regulations for Sukuk in Malaysia The Securities Commission SC supervises the Islamic capital market which operates parallel to the conventional capital market. FINANCIAL RISKS OF SUKUK STRUCTURES.

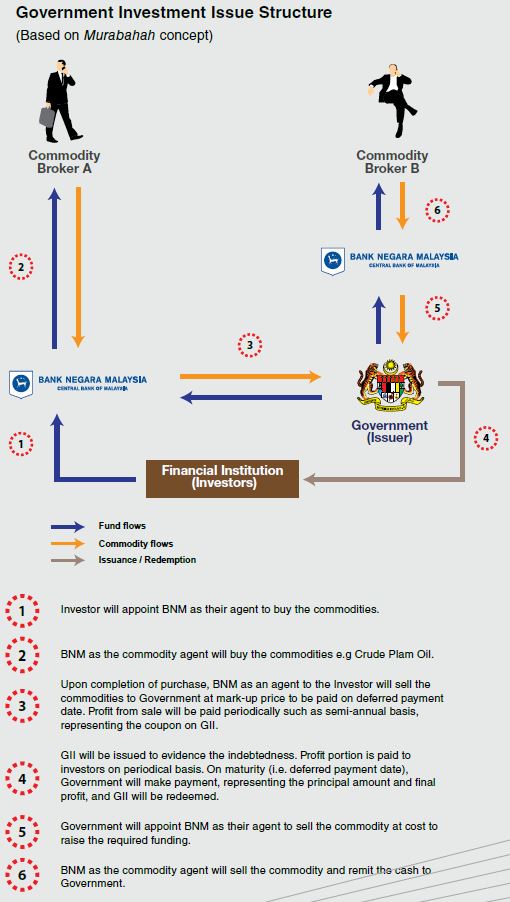

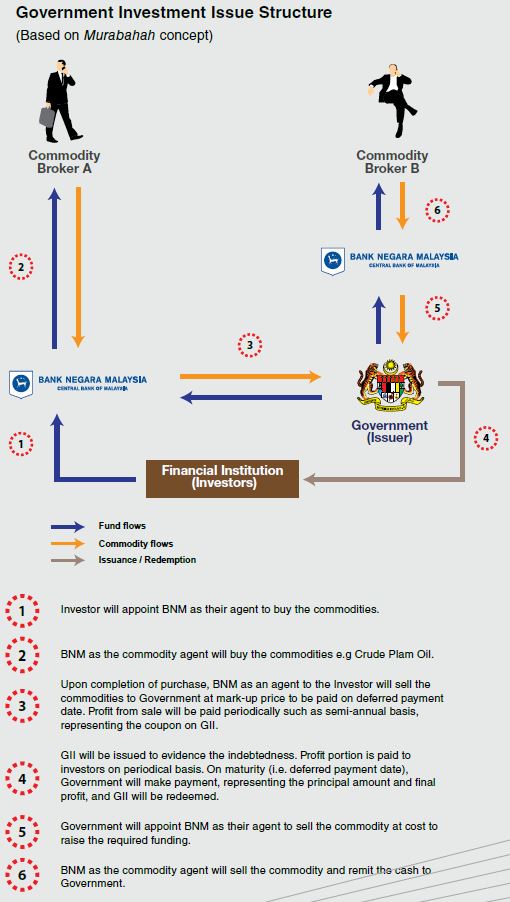

Indeed having a portfolio of different classes of assets allows for. Different types of sukuk are based on different structures of Islamic contracts Murabaha Ijara Istisna Musharaka Istithmar etc depending on the project the sukuk is financing. The SRI Sukuk Framework has enabled Malaysian entities to issue SRI sukuk in the form of green sustainable and social sukuk.

One hurdle when creating the necessary legal framework for sukuk in a countrys legislation is the differential treatment between profit and interest. Sukuk Issuance By Type Of Issuer In Malaysia Usd Mil Download Scientific Diagram What Is Sukuk. All sukuk contracts have a different.

HybridPooled Sukuk The underlying pool of assets can comprise of Istisnaa murabaha as well as ijarah. Explain the differences between Asset-Based and Asset-Backed Sukuk. Different types of sukuk are based on different structures of Islamic contracts Murabaha Ijara Istisna Musharaka Istithmar etc depending on the project the sukuk is.

Library Sukuk 101 Sukuk Types and Structures in. Sukuk are Sharia-compliant financial instruments referred. Types Of Sukuk Their Classification And Structure In Islamic Capital Market Springerlink.

This innovative Sukuk structure not only paves the way for other sovereigns to follow suit but also further affirms Malaysias position as the leader in international Islamic finance. Most of the time interest. For example Murabahah sukuk must pay.

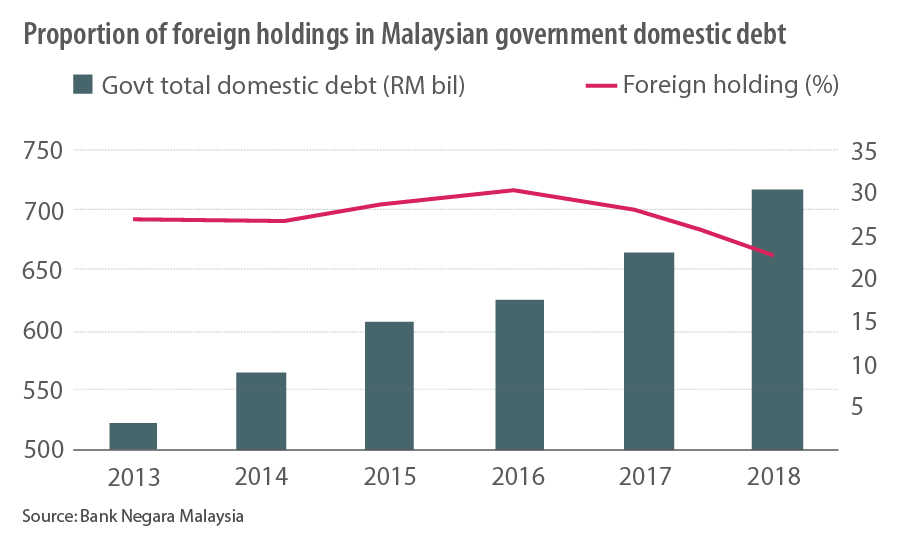

Based on the Rating Agency Malaysia Berhad RAM report in 2004 the Malaysian corporate sukuk market continued to expand and mature in 2004 affirming the role that Islamic finance.

Malaysia New Issuance Bonds And Sukuk 2020 Statista

First Sustainability Sukuk A Credit Positive For Malaysia The Star

Sukuk Contracts In Malaysia Bix

Sukuk Contracts In Malaysia Bix

Types Of Sukuk Their Classification And Structure In Islamic Capital Market Springerlink

Green Sukuk A New Legacy For Green Sprouts Saturna Capital

Article Archive Islamic Finance Foundation Sukuk Com

Malaysia Government Issues Myr 3 5 Billion Sukuk

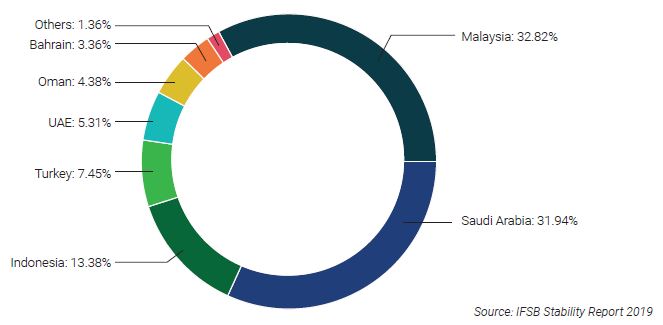

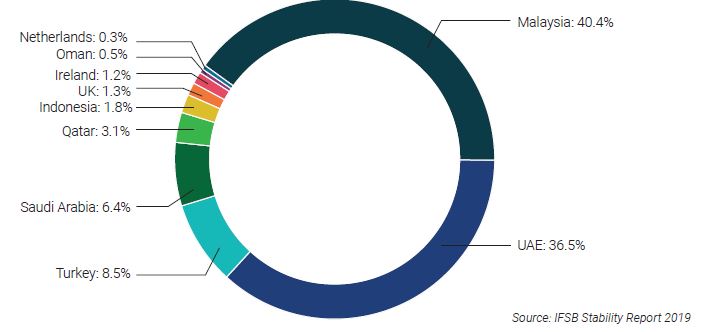

The Global Islamic Finance Market Part 1 Sukuk Bonds Tmf Group

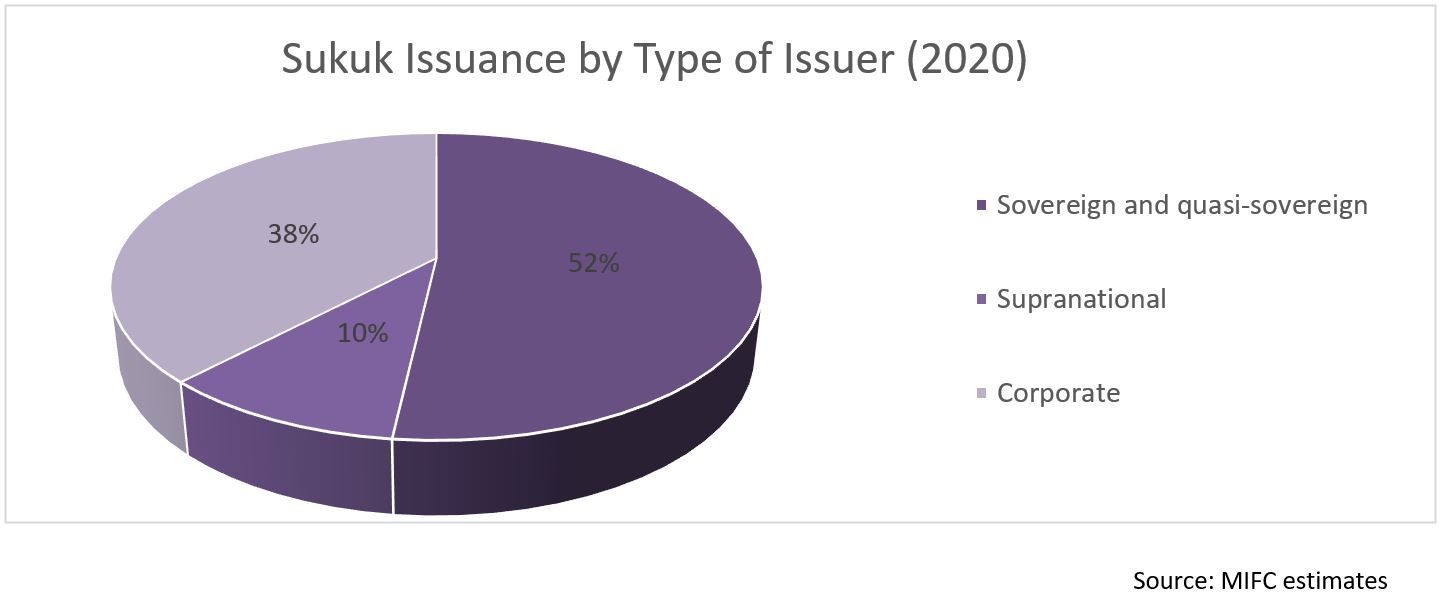

Sukuk Issuance By Type Of Issuer In Malaysia Usd Mil Download Scientific Diagram

Structure Of Ijarah Sukuk Issued By Tsh Co In Malaysia Download Scientific Diagram

Sukuk Issuance By Type Of Issuer In Malaysia Usd Mil Download Scientific Diagram

Article Archive Islamic Finance Foundation Sukuk Com

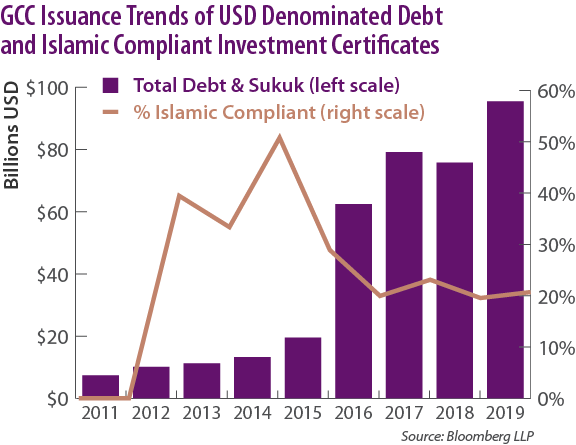

Gcc Sukuk A Primer Saturna Capital

Malaysia Remains Biggest Global Sukuk Market

Green Sukuk A New Legacy For Green Sprouts Saturna Capital

Sukuk Contracts In Malaysia Bix

The Global Islamic Finance Market Part 1 Sukuk Bonds Islamic Finance Worldwide